Your Guide To Uninsured Motorist Coverage In Alabama

Imagine driving home on a quiet evening when suddenly, another car runs a red light and collides with your vehicle. Thankfully, you’re not seriously injured, but your car is damaged, and the other driver speeds off before you can get their information. With no way to identify the hit-and-run driver, you’re left wondering how you’ll manage the repair costs and any medical attention you need. This kind of scenario is precisely where uninsured motorist coverage in Alabama (UM) becomes essential. It’s a situation anyone could find themselves in, highlighting the critical importance of being prepared with the right insurance coverage in Alabama.

And despite laws mandating liability insurance, a significant number of Alabama drivers — nearly 20% — lack liability insurance coverage, leaving others at risk.

We’ve created this guide to uninsured motorist coverage in Alabama to help you understand:

- How UM coverage works

- When you need it

- How it can protect you from the financial fallout of an accident with an uninsured driver.

By exploring the ins and outs of Alabama’s UM coverage requirements, the claims process, and practical tips for ensuring you have adequate protection, this article aims to equip you with the knowledge to navigate the roads more securely.

The Problem of Uninsured Drivers in Alabama

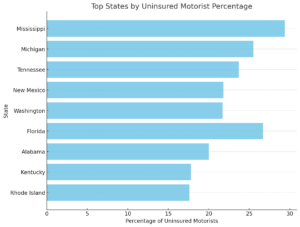

Alabama has a higher-than-average rate of uninsured drivers compared to the rest of the United States. Approximately 20% of motorists in Alabama do not carry the mandatory liability insurance, placing it among the states with the highest rates of uninsured drivers. This situation poses a significant risk to insured drivers, as accidents involving uninsured motorists can lead to complicated and often costly outcomes.

When an insured driver is involved in an accident with an uninsured motorist, the burden of covering repair costs, medical expenses, and other damages typically falls on the insured driver or their insurance company. This can lead to increased insurance premiums for all insured drivers, not just those directly involved in accidents with uninsured motorists.

The financial consequences of such accidents can be substantial. For example, the cost of repairing a vehicle after a collision can easily run into thousands of dollars, not to mention the potential medical bills associated with any injuries sustained. Given that the minimum required liability insurance coverage in Alabama is $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage, the expenses can quickly exceed these amounts, leaving insured drivers to cover the difference.

This high rate of uninsured drivers is not just a statistic; it’s a daily risk that affects the financial stability and safety of all drivers on Alabama roads. Understanding uninsured motorist coverage in Alabama and ensuring you have adequate protection is more than just a regulatory requirement—it’s a crucial financial safety net for you and your family.

What Is Uninsured Motorist Coverage in Alabama?

Uninsured Motorist (UM) coverage is a type of auto insurance designed to protect drivers and passengers if they’re involved in an accident with an at-fault driver who does not have liability insurance. In Alabama, as in many states, it’s not just an option—it’s a critical component of your auto insurance policy that ensures your financial protection.

Definition and Purpose

UM coverage steps in to cover expenses such as medical bills, lost wages, and vehicle repair costs that the at-fault driver’s insurance would typically cover if they had any. Given that nearly 20% of Alabama drivers are uninsured, the likelihood of encountering such a situation is not insignificant.

Coverage Details

- Bodily Injury UM Coverage: This covers injuries to you and your passengers. Alabama law requires that auto liability policies include UM coverage unless you specifically opt out in writing.

- Property Damage UM Coverage: While not mandatory in Alabama, this coverage can be added to protect against damage to your vehicle or property.

Legal Requirements of Uninsured Motorist Coverage in Alabama

Under Alabama law (Ala. Code § 32-7-23), insurers must offer UM coverage as part of any auto liability policy. However, policyholders have the right to reject this coverage in writing. The minimum UM coverage must match the state’s minimum liability limits:

- $25,000 for bodily injury per person

- $50,000 for total bodily injury per accident

- $25,000 for property damage

Opting Out

Choosing to opt out of UM coverage might lower your premium slightly, but given the high rate of uninsured drivers in Alabama, it’s a risky decision. Without UM coverage, you could be left covering significant costs out of pocket if you’re hit by an uninsured driver.

Key Takeaways

- UM Coverage is Essential: In a state with a high percentage of uninsured motorists, UM coverage provides a safety net.

- Legal Requirement: Alabama requires that you’re offered UM coverage but allows you to reject it.

- Financial Protection: UM coverage protects you from the financial risks posed by uninsured drivers, making it a crucial part of your auto insurance policy.

Understanding and selecting the right UM coverage can make a significant difference in your financial security following an accident with an uninsured motorist.

UM Coverage: Real-Life Scenarios and “Stacking”

Understanding uninsured motorist coverage in Alabama is made clearer through real-life scenarios. These examples illustrate how UM coverage can be a financial lifeline in various situations involving uninsured or underinsured drivers.

Scenario 1: The Hit-and-Run Accident

Imagine you’re stopped at a red light in Birmingham when suddenly, a car rear-ends you and speeds off. You’re left with a damaged car and minor injuries. With the other driver unidentified, you turn to your UM coverage. Because you have UM bodily injury and property damage coverage, your insurance steps in to cover the repair costs for your car and your medical expenses, up to the limits of your policy.

Scenario 2: The Underinsured Motorist

You’re involved in a more serious accident on I-65, where the at-fault driver has insurance, but only the minimum liability limits of $25,000 for bodily injury. Your medical bills quickly exceed this amount. Your UM coverage can cover the difference, up to your policy’s limits, ensuring you’re not out-of-pocket for the excess medical costs.

Understanding “Stacking” in Alabama

Alabama allows “stacking” of UM coverage. This means if you have multiple vehicles on your policy, you can combine the UM coverage limits for each vehicle for a single claim. For example, if you have three vehicles each with $25,000 in UM coverage, you can “stack” these to have a total of $75,000 in available coverage for a single accident.

- Example of Stacking: You own two cars, each insured with UM coverage of $50,000 per person. After a serious accident with an uninsured driver, you face $90,000 in medical bills. Through stacking, you can combine the coverage from both vehicles, providing you with up to $100,000 in coverage, thus covering your bills fully.

Key Takeaways

- Protection Against Uninsured Drivers: UM coverage provides crucial financial protection in accidents where the at-fault driver lacks sufficient insurance.

- Flexibility Through Stacking: Alabama’s stacking option can significantly increase your coverage in an accident, offering additional financial security.

- Coverage in Diverse Situations: Whether it’s a hit-and-run or an accident with an underinsured motorist, UM coverage can shield you from unexpected financial hardships from an automobile accident that was not your fault.

Need Help? We’re Here for You

Dealing with an accident with an uninsured or underinsured motorist can be especially challenging. The legal landscape might seem complex, especially when dealing with the nuances of filing claims, negotiating with insurance companies, or even pursuing litigation to protect your rights and secure the compensation you deserve.

At Jay Pickering Law, we understand the challenges and frustrations that can arise in these situations. Whether you or a family member has been involved in an accident where the other driver left the scene, lacked sufficient insurance, or was uninsured altogether, our firm is here to offer the support and guidance you need.

We’re committed to ensuring that victims of such accidents don’t have to navigate these difficult times alone. Our comprehensive understanding of uninsured motorist coverage in Alabama and the state’s insurance and liability laws means we can guide you through the process, advocate on your behalf, and fight for the best possible outcome for your case.

Don’t let the actions of an uninsured motorist compromise your medical treatment, financial stability or well-being. Reach out to Jay Pickering Law for a free consultation. We’ll discuss your case, explore your options, and outline the steps we can take together to move forward. Remember, you don’t have to face this alone—let an experienced personal injury attorney stand by your side.

Attorney Jay Pickering brings over 27 years of unwavering dedication to personal injury law, with a sharp focus on representing those injured in car, truck, and motorcycle accidents across Alabama. A proud alum of the University of Alabama School of Law, Jay is a member of the Alabama State Bar and the American Bar Association.